Chapter 12 Selfmanaged superannuation funds ppt download

This means that APRA-regulated funds can apply to the government for compensation and can get resolution for disputes and complaints without paying fees, while SMSFs cannot.. When this happens, the tax penalties can be very costly. In the year that a super fund changes from being a resident to being a non-resident fund, the market value of.

APRA Chair Wayne Byres Speech to the Financial Review Banking Summit 2022 APRA

APRA funds must: use the SuperStream standard to process rollovers, and validate rollovers. use the SMSF Verification Service to verify self-managed super fund (SMSF) details before making rollovers to SMSFs. use the SMSF member verification system to confirm if a member requesting a rollover to an SMSF is a member of that SMSF. use the Fund.

SMSFs vs APRA Regulated Super Funds YouTube

Choosing a super fund is difficult enough, and it's not helped by the fact there are hundreds of different super funds offering seemingly identical products. To help you understand the wide range of super funds that are available, on this page you can find a list of all super funds that are regulated by APRA.

Completing a Super Choice Form NAVA

APRA and ASIC publish latest data on life insurance claims and disputes - December 2023. APRA's Life Insurance Claims and Disputes Statistics publication presents the key industry and entity-level claims and disputes outcomes for 17 Australian life insurers writing direct business (i.e. excluding reinsurance). 15 April 2024.

The best and worst super funds APRA

APRA acknowledges the traditional owners and custodians of the lands and waters of Australia and pays respect to Aboriginal and Torres Strait Islander peoples past and present. We would like to recognise our Aboriginal and Torres Strait Islander employees who are an integral part of our workforce.

APRA raises the bar for buyers of superannuation fund The Australian

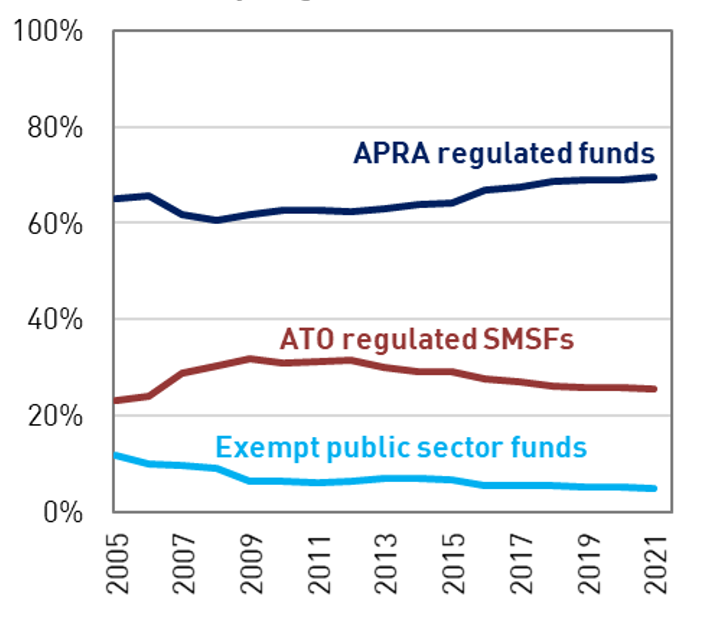

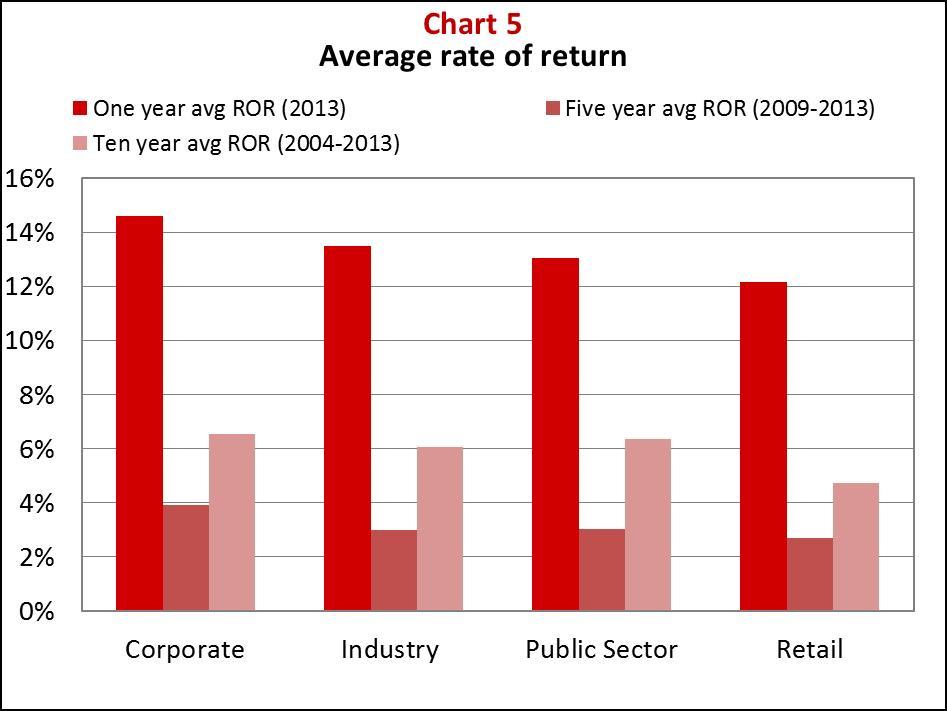

The Self-managed super fund takeaway. Self-managed super funds can offer control, flexibility and sometimes greater choice. However, the statistics also suggest that, on average, they under perform against APRA-regulated funds and can be more costly and time-consuming than anticipated. That doesn't mean that a SMSF is a bad choice for you as.

UniSuper, Australian Ethical the 10 topperforming super funds in APRA’s performance test

If you choose your own super fund you will need to obtain current information from your fund to complete items 3 or 4. Item 3 Nominating your APRA fund or RSA Complete this item if you are nominating your own APRA fund (fund regulated by the Australian Prudential Regulation Authority) or a retirement savings account (RSA).

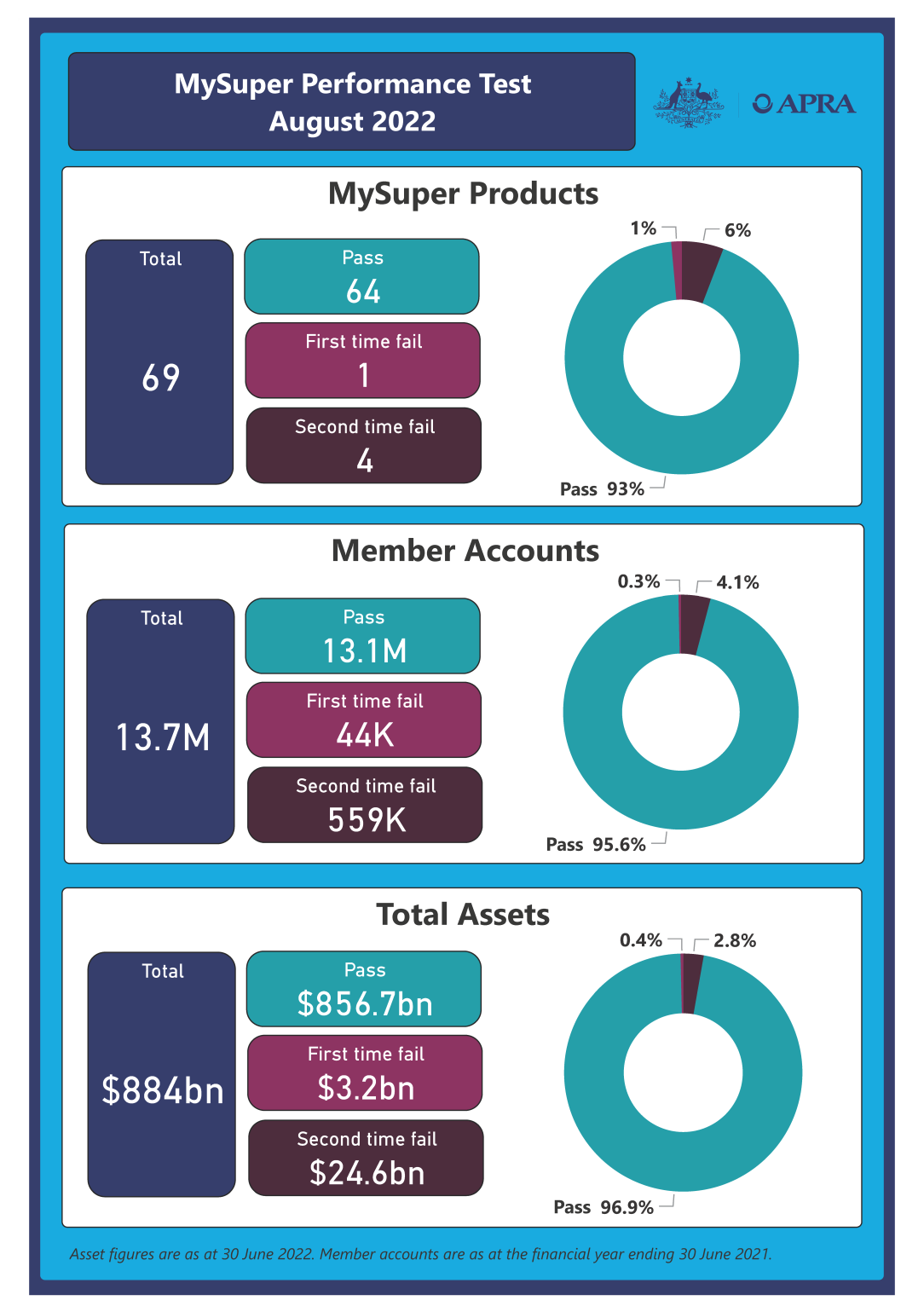

The Annual Superannuation Performance Test 2022 APRA

According to the SMSF Association, SMSFs only become an overall cheaper alternative to APRA regulated fund if the total fund value exceeds $500,000. Before this point, an APRA regulated fund may be more cost effective depending on which investment option the member chooses to invest in.

APRA puts more than 116 super funds on notice with retail sector in firing line The Australian

If your employee is nominating an APRA regulated fund or retirement savings account, they can obtain the information required from their current fund. If your employee is nominating a self-managed super fund (SMSF), it's important they provide the SMSF electronic service address (ESA), bank account information and supporting documentation, so.

Superannuation Fund Types Wealth IQ That's Money Smart

Rest Super's close shave with APRA test. Michael Roddan National correspondent. Sep 3, 2021 - 5.00am. The $60 billion Rest Super resubmitted data to the prudential regulator's new.

UniSuper, Australian Ethical the 10 topperforming super funds in APRA’s performance test

The Australian Prudential Regulation Authority (APRA) has released the results of its latest assessment of Australia's superannuation sector revealing the best performing MySuper products from each super fund in 2022.. APRA's data shows that the list of 10 top-performing default MySuper products was dominated by industry super funds and includes options from AMP, Australian Retirement.

The super system what is on APRA's watchlist? APRA

All superannuation funds are regulated under APRA, and therefore called an 'APRA fund'. If you're with Student Super, you should check this first box. A retirement savings account or (RSA) is a type of long-term savings account, provided by a bank, building society, credit union or life insurance company, however RSAs are now fairly uncommon.

APRA takes aim at super funds over marketing spend including sporting sponsorships The Australian

In detail. Detailed information about APRA-regulated funds. QC 24720. Services, support and obligations for super funds regulated by the Australian Prudential Regulation Authority (APRA).

Completing a Super Choice Form NAVA

The bottom line. When you start a new job, you will generally be handed a document asking you to nominate a superannuation fund. This document is called the Superannuation Standard Choice Form. Issued by the Australian Taxation Office (ATO), it allows you to choose the fund your employer's contributions will be paid into on your behalf.

APRA data shows super fund underperformance endures but fees have fallen Herald Sun

The new stapled super fund step only applies from 1 November 2021 when a new employee does not choose their own super fund. You can support your members to choose their own super fund by: helping them to understand the super standard choice form. reminding them of the benefits of choosing their own super fund and keeping track of their super.

APRA results target to keep heat on super funds The Australian

This is the register of all registrable superannuation entities (RSEs) and RSE licensees regulated by APRA in accordance with the Superannuation Industry (Supervision) Act. The Registrable Superannuation Entities (RSE) Register displays the information prescribed in Part 11A of the Superannuation Industry (Supervision) Amendment Regulations.

.