Super Bonus 2017 YouTube

Calculated at around 17.5% of an employee's base rate of pay, eligibility and rates are determined by awards, agreements, or contracts. Similar to bonuses, leave loading is considered 'ordinary times earnings,' subject to Superannuation Guarantee. Further, leave loading contributes to the overall 'wage' figures for the purposes of assessing.

Super Bonus OnlineCasinoHub

OTE is the amount you pay employees for their ordinary hours of work, including things like commissions and shift loadings. salary and wages to work out the super guarantee charge. You only need to do this if you missed paying the minimum super guarantee contribution by the due date. Salary and wages are similar to OTE but also includes any.

What are Bills Payable?

A bonus is typically a form of monetary compensation that you pay your employees in addition to their regular wage or salary. However, bonuses can be in the form of a reward other than a cash payment. In saying that, the two main types are: contractual; and. discretionary.

BC GAME Deposit Bonus Guide

Employers need to pay super on bonuses if certain requirements are met. Under the superannuation guarantee (SG) rules, if your bonus counts as 'ordinary time earnings', then your employer has to make a super contribution for that bonus. For the 2023-24 financial year, that's a minimum super contribution of 11%, though they may choose to.

What are Accrued Expenses Payable?

5 min read. Superannuation guarantee payment dates. Quarter. Superannuation contributions due date. Super guarantee charge due date. 1 July - 30 September. 28 October. 28 November. 1 October - 31 December.

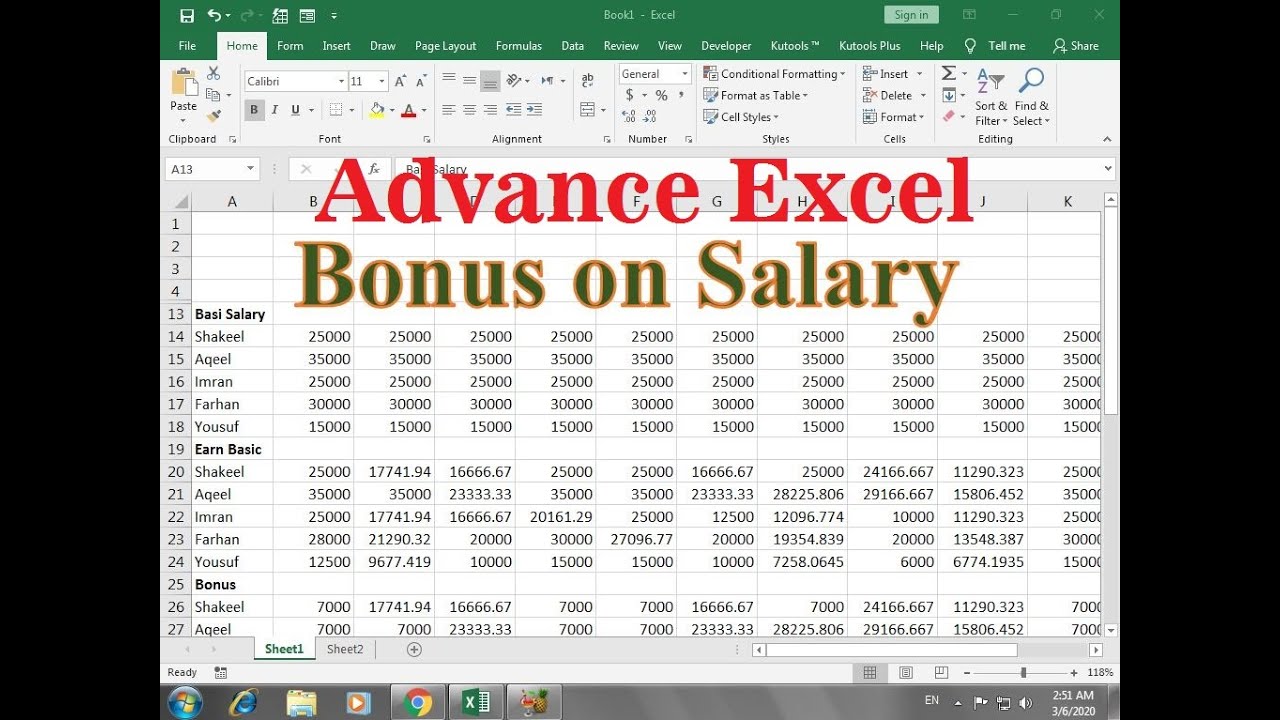

how to calculate bonus on salary in excel YouTube

Hi @Joybiter, Thanks for getting in touch! As super guarantee is paid for eligible employees ordinary time earnings (OTE), annual/long service leave while employed and paid as a lump sum or while on leave is considered OTE and is referred to in section 32, 67, 235-240 of our ruling SGR 2009/2. Generally, bonuses are considered OTE when a bonus.

Bonus 365 Casino

Usually, the answer is yes; any bonus payments you receive from your employer will impact the assessment of how much your superannuation payments should be. But, there are some exceptions to this. To understand what you're entitled to, it's a good idea to understand the different bonus types and when an employer will pay superannuation on a.

Super Bonus Antiques Vintage Rusty Metal Sign On A White Background Stock Vector Illustration

The tax rate that you will pay on your bonus will depend on the income bracket that you fall into in 2022: Basic rate: for earners making between £12,571 to £50,270, your bonus will be taxed at 20%. Higher rate: for those making between £50,271 to £150,000, your bonus is taxed at 40%. Additional rate: for earners making over £150,000, your.

The Insider Assiniboia Downs

Gumtree's most popular items include rare stamps, Gameboys and Pokemon cards. Read this and all the latest consumer and personal finance news below, plus leave a comment or submit a consumer.

Label or badge with text extra bonus isolated on white background. Super bonus stamp. Vector

CareSuper doesnot currently offer a retirement bonus) None. N/A. 0.3% of balance. Subject to change, check retirement bonus fact sheet here. Not available when converting TTR to retirement. Not available when using a death benefit to commence a pension. Brighter Super. None.

Best Credit Card BONUSES July 2021 YouTube

1. Talk to your line manager: Often the quickest and easiest a way to challenge a bonus is to have a discussion with your line manager. They may be able to provide you with an explanation regarding the amount offered, or be able to consider any points you may raise to try to resolve matters. 2. Raise a formal grievance: If you are not happy.

Extra Super Bonus Limited Time. Stock Vector Illustration of market, mega 47255032

The answer for the most part is that employers do pay super on bonuses and other ordinary time earnings 1, but there is a situation in which employers are not required to pay super on bonuses. It is important to note, however, that some employers, including the Queensland Government, have different contribution arrangements and, in those cases, employer obligations may differ from those.

Premium Vector Extra bonuses

In other words, employers must pay super on what an employee earns for their ordinary hours of work, which depending on the employee may include certain allowances, annual leave, sick leave and certain types of bonuses. So, whether an employer must pay super on bonus payments will depend on whether the bonus is within the employee's OTE.

Casino bonuses Cashback bonus explained Online Slots & Casino reviews with the best bonuses

The way PAYE works is that when someone earns over x amount deemed to be the 40% tax threshold bracket then that is taxed at 40%, even if it is only a one off bonus. i.e say the threshold was £700pw, but because of a bonus, he was paid £1500pw, that £1500 would be over the 20% threshold so would be taxed at 40% on it.

Super and extra bonus labels Royalty Free Vector Image

The minimum super contribution for Sue for the pay period is: $3,000 × 11% = $330. Peter contributes $330 for the July to September quarter to Sue's super fund by the quarterly due date of 28 October 2023. The SG rate on the date the salary is paid applies. The SG rate increased to 11% on 1 July 2023.

Contact Get Bonus

So in summary, superannuation is most probably payable on a performance bonus, a Christmas bonus, Easter bonuses, EOFY bonuses, you get the drill. And remember to withhold that tax! (ie, if you want to pay a $1,000 bonus to a staff member (lucky them!), tax will be taken out and you'll also have to pay super on top of it).

.