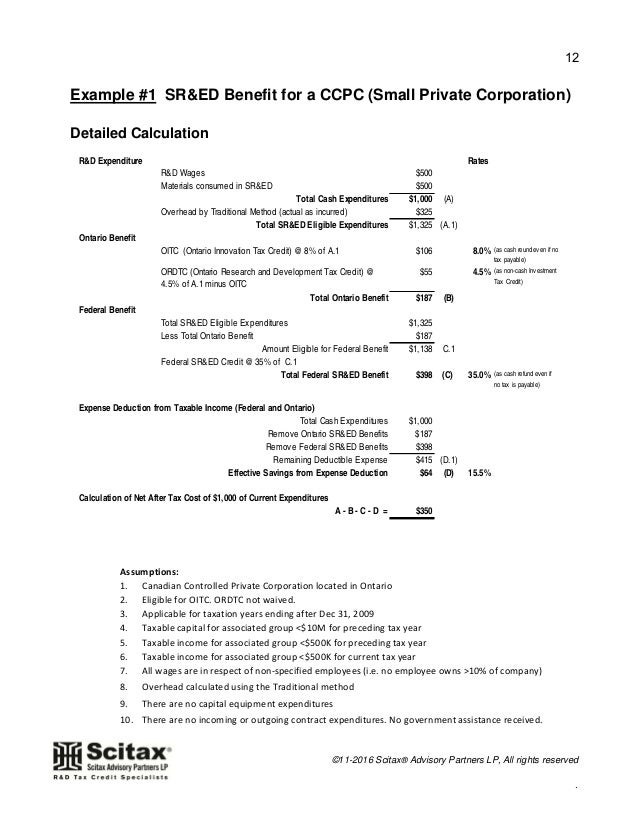

Introduction to R&D Tax Credits in Canada with Worked Examples for Sm…

The R&D Tax Credit isn't refundable. If you don't owe income tax or if the credit is worth more than what you owe, you won't receive a check from the IRS. Most businesses will use the 20-year carryforward to apply their unused credit to future years' taxes. Eligible small businesses can also opt to apply the credit towards their payroll.

Which Industries Qualify for the R&D Tax Credit? Specialist R&D Tax Advisors

Buyer beware. For sole proprietorships, partnerships, and S-corporations the R&D credit is claimed by filing Form 6765 with the business return (Schedule C of a Form 1040, Form 1065, or Form 1120.

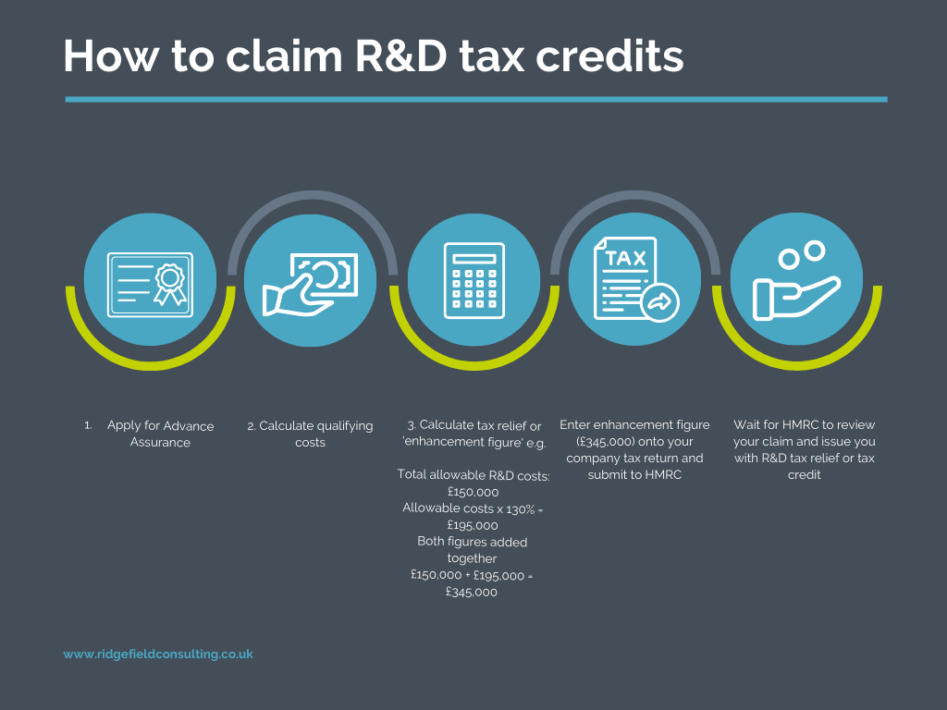

Claiming R&D Tax Credits A StepbyStep Guide

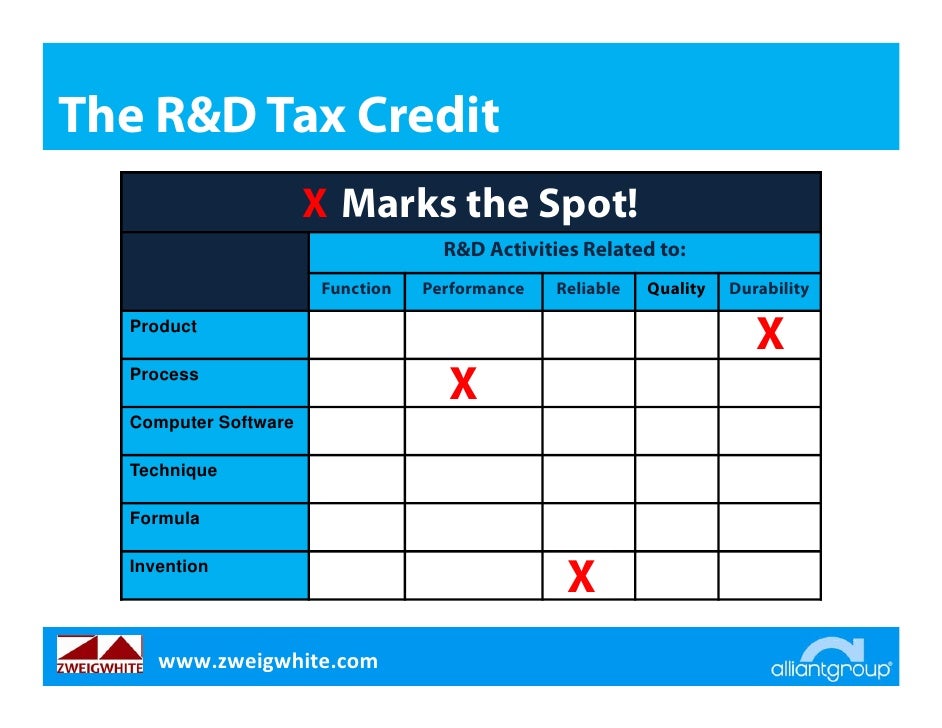

R&D tax credits are available to all organizations that engage in certain activities to develop new or improved products, processes, software, techniques, formulas or inventions. This accessibility is partly due to the Protecting Americans from Tax Hikes (PATH) Act of 2015, which broadened the ability of many small-to-midsize businesses to.

R&D Tax Credit Explained National Referral Network

The R&D tax credit is a tax incentive designed to encourage research activities relating to developing or improving products, processes or software.It was introduced in 1981 by the federal government and was later made permanent by Congress through the Protecting Americans from Tax Hikes (PATH) Act in 2015. The rules for the R&D tax credit are outlined in Section 41 of the Internal Revenue Code.

How To Be Proactive With R&D Tax Credits Accountants Guide

The research and development tax credit (R&D credit) is a general business credit available to businesses that created or improved a product or process. Businesses that are eligible to receive the R&D credit must have participated in qualified R&D activities as outlined under Section 41 of the IRS Tax Code .

R&D tax credits explained what are they? made.simplr

The R&D tax credit may help to mitigate the increased tax liability caused by the Sec. 174 amortization. Inflation Reduction Act (IRA) of 2022. Effective for tax years beginning on or after January 1, 2023, the IRA increases the annual payroll offset for the R&D tax credit from $250,000 to $500,000. In addition, qualified small businesses can.

R&D Credit Quintessential Tax Services US and International Tax Services, and Consultation

The R&D tax credit was originally established in 1981 to incentivize innovative R&D across the United States. The 2015 Protecting Americans from Tax Hikes (PATH) Act made the R&D tax credit permanent, modified the benefit for small businesses, and made the credit available to startups. While the phrase "research and development" might call.

How Much R&D Tax Credits Can I Claim? NSKT Global

The tax code has supported R&D primarily through two policies: 1) allow for companies to elect to expense R&D costs (i.e. deduct in the first year); and, 2) provide for a tax credit for certain R.

R&D Tax Credits Research and Development Topel Forman LLC CPAs

The R&D tax credit is available to companies developing new or improved business components, including products, processes, computer software, techniques, formulas or inventions, that result in new or improved functionality, performance, reliability, or quality. It's available at the federal and state level, with over 30 states offering a.

R&D Tax CreditsR & D Tax CreditsClaim what you deserve

The R&D Tax Credit (26 U.S. Code §41) is a federal benefit that provides companies dollar-for-dollar cash savings for performing activities related to the development, design, or improvement of products, processes, formulas, or software. This credit provides much needed cash to hire additional employees, increase R&D, expand facilities, and more.

R&D Tax Credits for the Healthcare Industry

The research and development (R&D) tax credit is one of the most significant domestic tax credits remaining under current tax law. Savvy corporate tax teams can use this important tool to implement federal tax planning strategies that maximize their company's value.. However, the tax issues around R&D investment and acquisitions are not trivial.

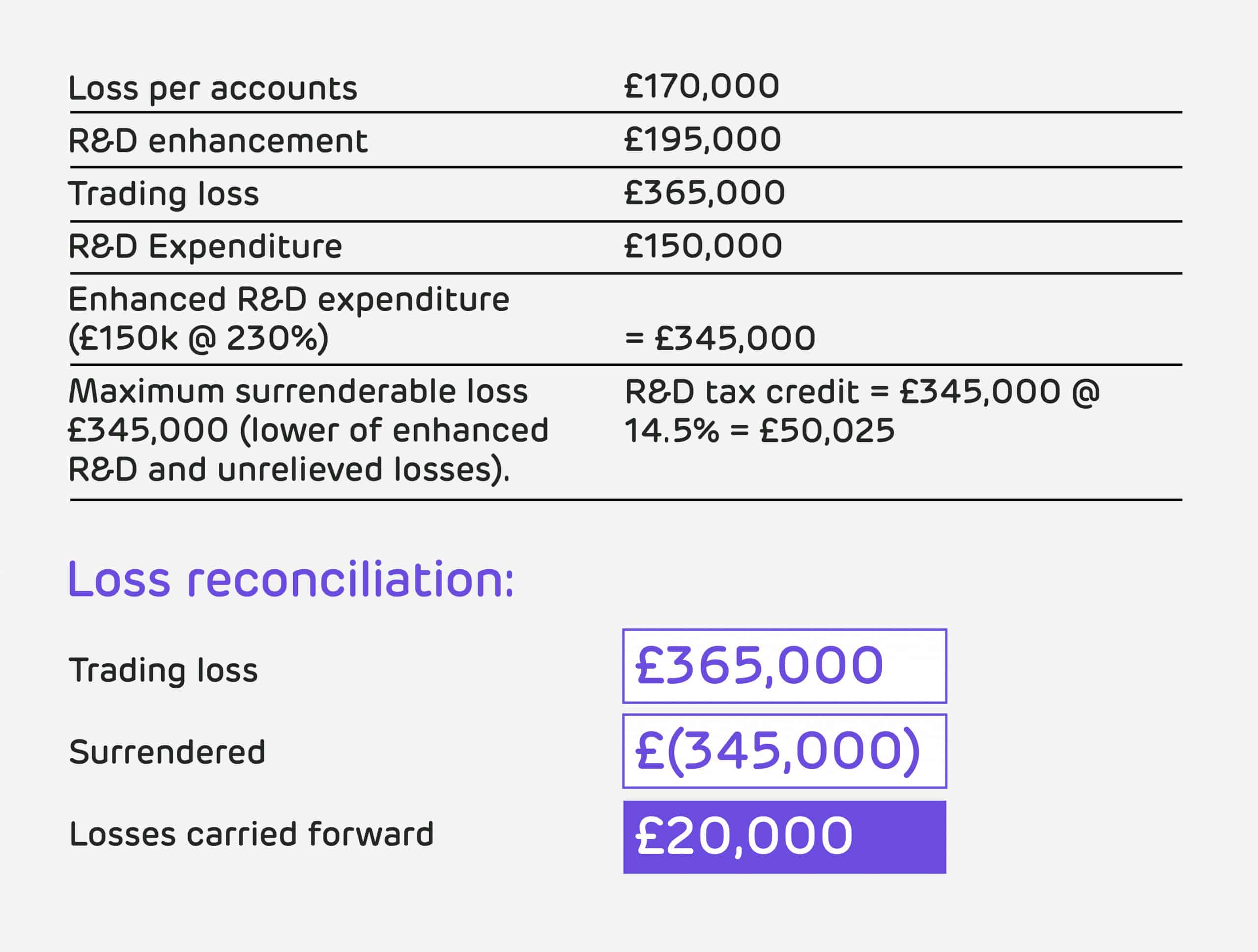

R&D Tax Credits UK What Is It & How To Claim Capalona

The R&D tax credit can help offset BEAT payments for tax years prior to December 31, 2025, could this help you? Is there an opportunity to forgo the 280C election and amortize R&D expenses to minimize the BEAT implications? If states like California (CA) limit the use of NOLs and R&D credits?

R&D Tax Credits An Opportunity for Economic Relief SVA

The R&D tax credit has many benefits, like creating a dollar-for-dollar tax liability reduction and improving cash flow. However, it can be a challenge to understand the complex tax system well enough to get the most value for your business. Taking advantage of available money-saving opportunities often requires help from professionals.

Funding Innovation with R&D Tax Credits Fleming

R&D tax credit rules summary. Federal and certain states tax laws permit a research and development (R&D) tax credit to the extent that a taxpayer s current-year qualified research expenses exceed a calculated base amount of research spending. The federal and state credit benefits are generally greater than 10 percent of qualified spending for.

How do you claim R&D tax credits?

R&D Tax Credit Services. We can help companies identify federal and state R&D tax credits, enabling them to realize cash tax savings for qualified research activities. We combine our leading R&D tax knowledge and services with an innovative web application called Global Incentives Solutions, R&D tax credit software designed to effectively and.

How do R&D Tax Credits can Transform your Business?

Created in 1981 to stimulate research and development (R&D) in the United States, the R&D tax credit is a dollar-for-dollar offset of federal income tax liability and, in certain circumstances, payroll tax liability. Most states provide a similar credit, making the average potential benefit of the federal and state credit in the range of 10-20%.

.