VAT (number) Help Section

GST on imported goods and services. Australian GST may apply to you for retail sales of imported services, digital products or low value imported goods.

VATnumber. What is that and how to get it? CloudOffice

Australia applies a VAT system that is similar with the one that can be found in European countries.The difference is that VAT in Australia is named the Goods and Services Tax (GST).. This tax applies for all goods and services that are traded at a national level and companies that sell such products in Australia will have to register for VAT in certain situations.

How to find a business's VAT number? Experlu

Hi @j0red, What a great question! The first thing I suggest you do is have a look at your GST registration letter you would have received after 10 days of registering and it would have been posted out to you. If you did not receive this you can contact us to request another letter to be sent to you.

VAT Registration What Is It and Why You Need To Legend Financial

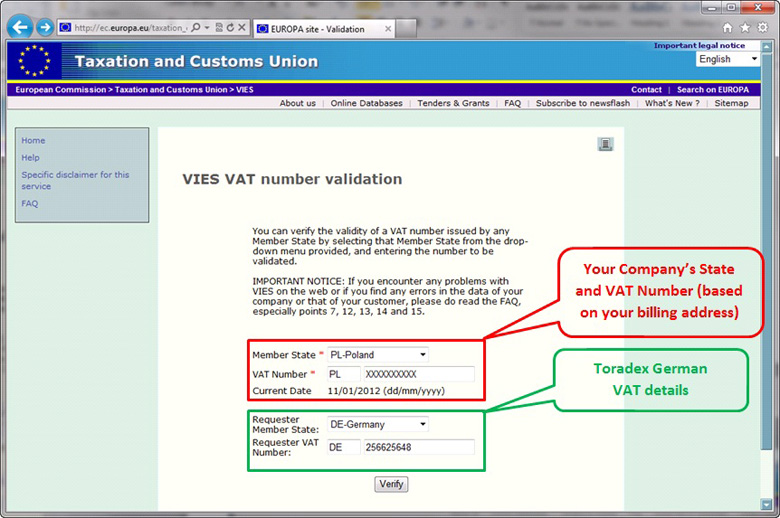

A value-added tax identification number or VAT identification number (VATIN) is an identifier used in many countries, including the countries of the European Union, for value-added tax purposes. In the EU, a VAT identification number can be verified online at the EU's official VIES website. It confirms that the number is currently allocated and can provide the name or other identifying details.

Infographic A guide to VAT in Australia Innovate Tax

What is GST or goods and services tax? GST is a general tax added to most products and services consumed or sold in Australia. This tax can be described as VAT or Value Added Tax. Generally, this tax is payable on the value businesses, and other organisations add at each stage of the commercial chain of both goods and services, which is further.

How to setup VAT(UK) or GST (Australia) BridalLive

VAT number in Australia is referred to as GST and it stands for Goods and Services Tax. It is a form of Value Added Tax that is charged in countries like Australia, India, Canada, New Zealand, Singapore, and Hong Kong. GST works in the same way as VAT in that it is a consumption tax that is imposed upon the cost of goods and services.

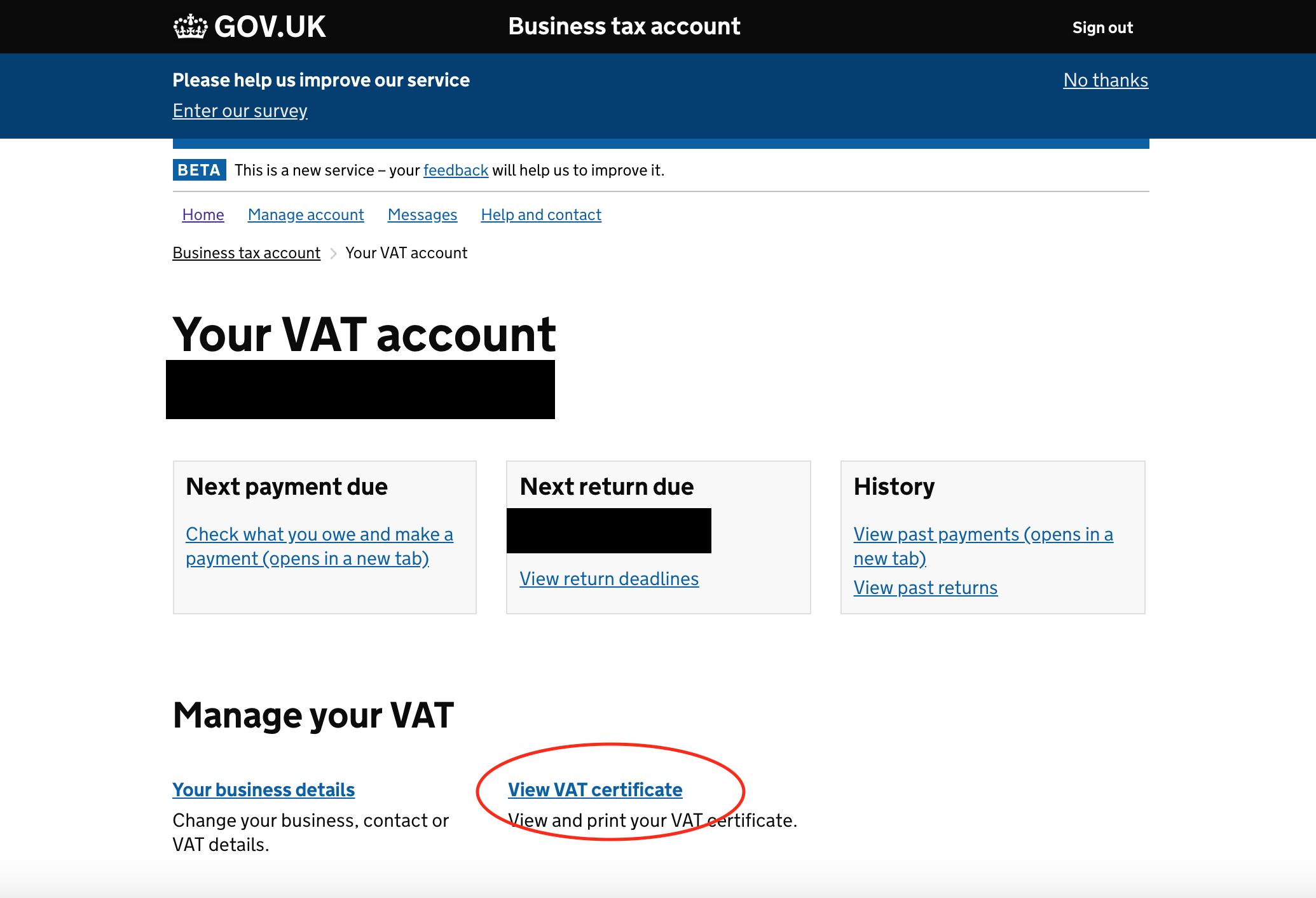

How to view your VAT certificate online (Updated for 2023) Unicorn Accounting

Learn about VAT within Australia. Find out which goods or services are liable to VAT, when to register and how to pay VAT. Get VAT news in Australia.. Get EU VAT number; Help with VAT returns; Contact Us +44 (0) 1273 022400; Monday - Friday 8:00am - 6:00pm; Chat with us;

Toradex How to validate the EUVAT number?

three numbers (for example XXX XXX XXX) but is stored as an eight or nine number string on internal systems. The ABN is a unique 11 digit number formed from a nine digit unique identifier and two prefix check digits. The two leading digits (the check digits) will be derived from the subsequent nine digits using a modulus 89 check digit calculation.

VAT Number Bookairfreight Shipping Terms Glossary

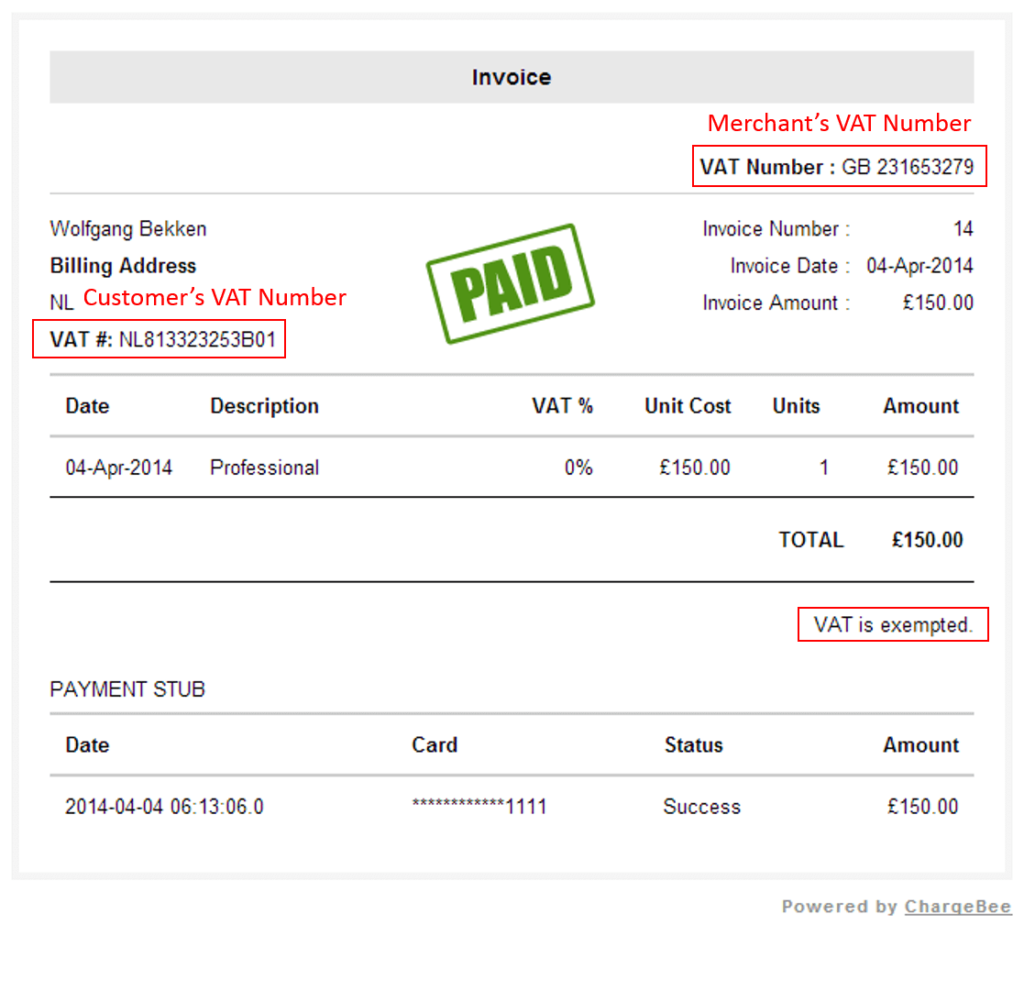

Look at the company's invoices, insurance forms, or tax documents for the VAT number. It will contain 2 letters and multiple digits. Try searching for the company on a VAT search engine to find their identification number. Contact the company directly and ask for their VAT number.

VAT calculator (Australia)

Value Added Tax in Australia. Value added tax (VAT), or Goods and Services Tax (GST) as it is called locally, is a type of indirect consumption tax imposed on the value added to products or services, specifically during different stages of the supply chain.. Its local name is Australian Business Number (ABN). The end-consumer at the end of.

How VAT works and is collected (valueadded tax) Perfmatters

GST on low value imported goods. GST applies to most retail sales of low value physical goods imported by Australian consumers. This affects goods valued at A$1000 or less including items like clothing, cosmetics, books and electric appliances. This A$1000 threshold is based on the customs value, which means transport and insurance costs are.

How to Find a Business’s VAT Number? CruseBurke

A Value Added Tax Identification Number or VAT Identification Number (VATIN) is an identifier used in many countries for value added tax purposes. In the European Union, a VAT Identification Number can be verified online at the official EU VAT Information Exchange System (VIES) website. You can use this website to confirm that the number is.

Australian Vat Calculator January 2024 with updated VAT Rates

GST In Australia. In Australia, they use a system very similar to VAT called the Goods and Services Tax, or GST for short. It's their version of this value-added tax concept, and it's been in place since the year 2000. What's interesting about GST in Australia is that it has some advantages. It's a fairer way to collect taxes because.

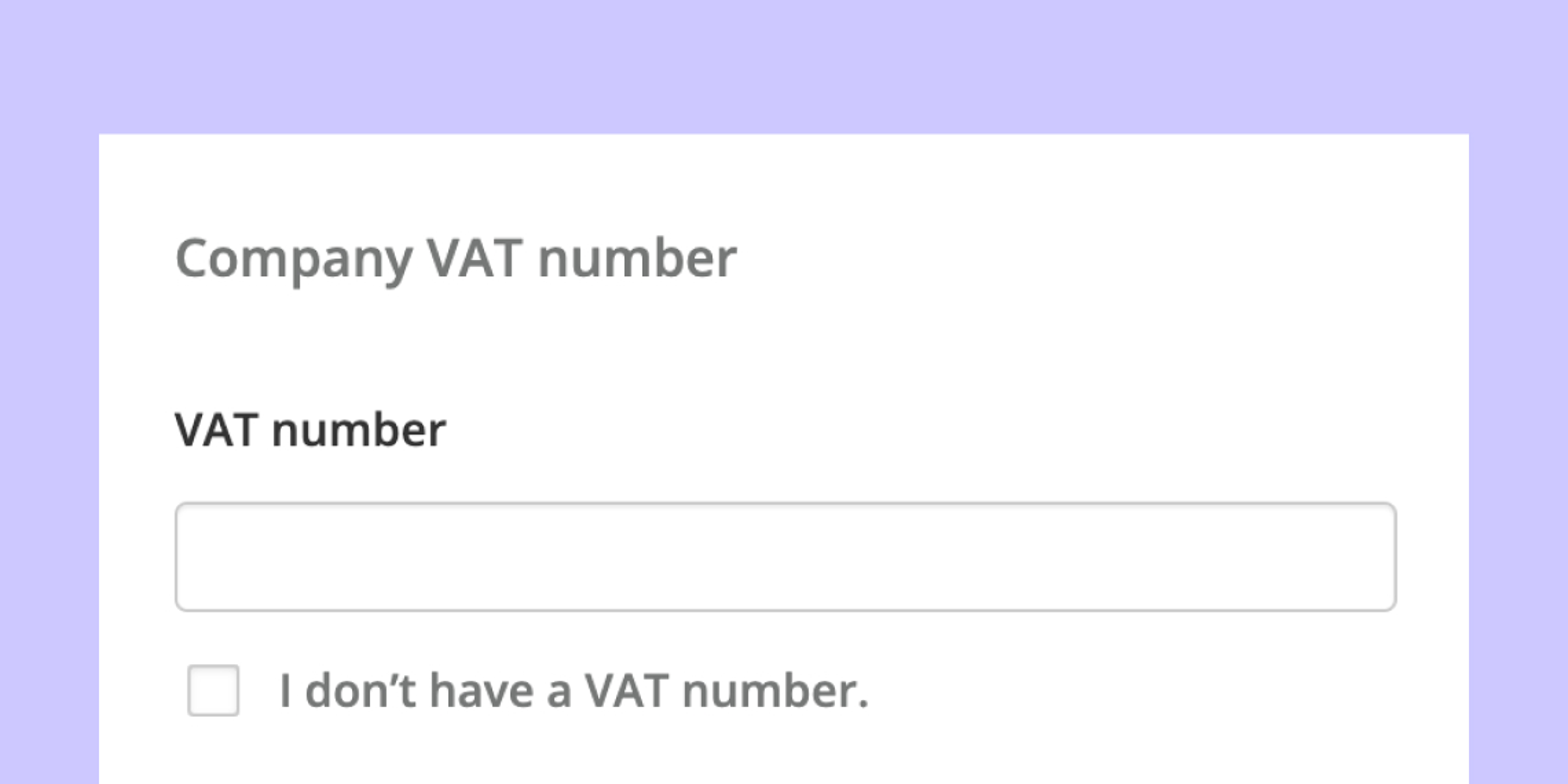

What is a VAT number?

How to work out VAT in Australia. Total price including VAT. To work out the total price at the standard rate of VAT (10%), multiply the original price by 1.1. Total price excluding VAT. You can calculate the total price excluding the standard VAT rate (10%) by dividing the original price by 1.1.

Premium Photo Vat invoice with australian money

What About VAT in Australia? Standard VAT tax in Australia is known as Goods and Services Tax (GST) and this figure is a set rate of 10%. It applies to most goods and services but does not include things such as basic foods, some medical and healthcare services, and some educational classes. To work out the total VAT or GST, multiply the.

Making sense of your electricity bill Renewable energy help centre City of Sydney

For businesses in Australia, the threshold for VAT registration is an annual turnover of $75,000 or more. If your business exceeds this threshold, you are required to register for VAT and charge it on your taxable supplies. This means you must charge VAT on the goods or services you sell to your customers.

.